Gulf Oil Lubricants India Ltd. – Powering a Bright Future

Gulf Oil Lubricants India Ltd. (GOLIL), a part of Hinduja Group, is a leading player in India’s lubricants industry, offering automotive and industrial lubricants. Established in 2008, headquartered in Mumbai, the company operates in automotive, industrial, and export sectors. It boasts a robust distributor network of over 80,000 touch points, servicing 40+ OEMs and 500+ B2B clients.

Product Portfolio

- Automotive lubricants

- Industrial lubricants and specialty oils

- EV fluids

- Marine Lubricants

- AdBlue

- 2-Wheeler VRLA Battery

Subsidiaries: As of FY23, GOLIL does not have any subsidiaries, but it has one holding and one associate company.

Growth Strategies

- Strategic expansions into the EV infrastructure market.

- Leading in AdBlue provision.

- Diversification into related sectors like battery technology and charging infrastructure.

- Collaboration with key players in the automotive and EV industry for research and development.

- Focus on innovation and product development to meet evolving market demands.

- Strengthening distribution channels to reach untapped markets and increase market penetration.

Financial Highlights

- Q3FY24 Performance:

- Achieved highest ever quarterly revenue: Rs.817 crore.

- Operating profit increased by 23% YoY to Rs.111 crore.

- Net profit surged to Rs.81 crore, marking a 29% increase compared to Q3FY23.

- Core lubricants business grew by 5.8% YoY during the quarter.

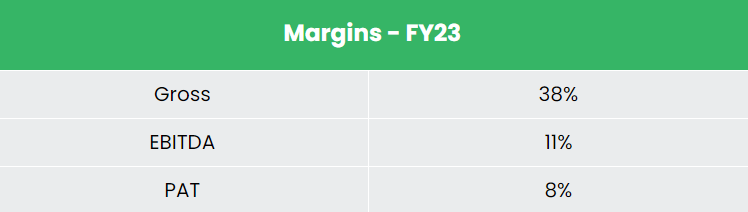

- Operating margin: 14%.

2.Financial Performance:

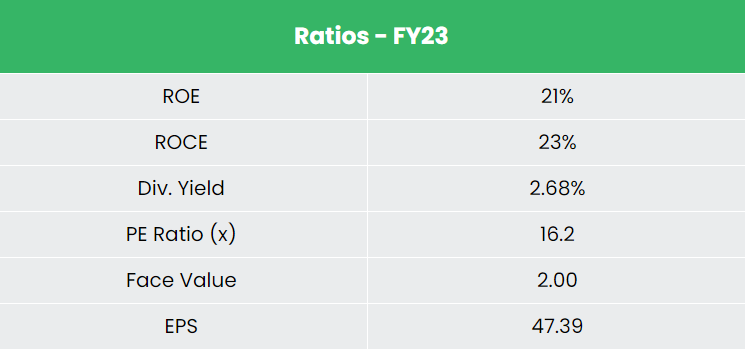

- Revenue and PAT CAGR (FY18-23): 22% and 5%.

- Average ROE (Return on Equity) for FY18-23: 25%.

- Average ROCE (Return on Capital Employed) for FY18-23: 28%.

- Debt-to-equity ratio: 0.34.

Industry Outlook

- Market Size: India ranks as the world’s third-largest lubricant market, poised for continued growth.

- Technological Advancements: Advancements in lubricant technology drive product innovation, meeting diverse industry needs.

- Environmental Regulations: Stringent environmental regulations propel demand for eco-friendly lubricants, influencing market dynamics.

- International Trade: India’s lubricant market actively engages in international trade, facilitating global partnerships and market expansion.

- Consumer Awareness: Increasing consumer awareness regarding the benefits of quality lubricants fuels demand, shaping market trends.

Growth Drivers

- Growing GDP and domestic consumption.

- Infrastructure investments.

- Government initiatives like Atmanirbhar Bharat and Automotive Mission Plan 2016-26.

- Transition towards electric vehicles, with the Indian government aiming for 30% of new vehicle sales to be electric by 2030.

- Increasing awareness and adoption of environmentally friendly solutions like AdBlue.

Competitive Advantage

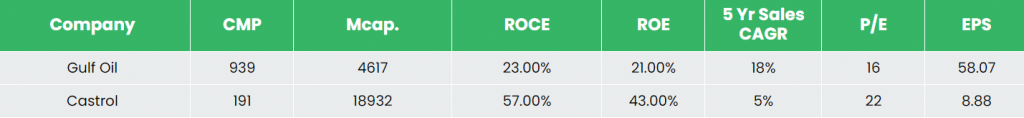

- Gulf Oil is undervalued compared to competitors like Castrol India Ltd.

Outlook

- Gulf Oil aims to surpass market growth rates.

- Strong position in AdBlue market.

- Investments in EV business anticipated to yield returns.

- Sales distribution indicating potential pricing power.

- Margin guidance range: 12-14%.

- B2C accounted for approximately 58% of sales, with B2B making up the remaining 42% for the quarter, compared to 56% B2C and 44% B2B in the previous quarter.

Valuation

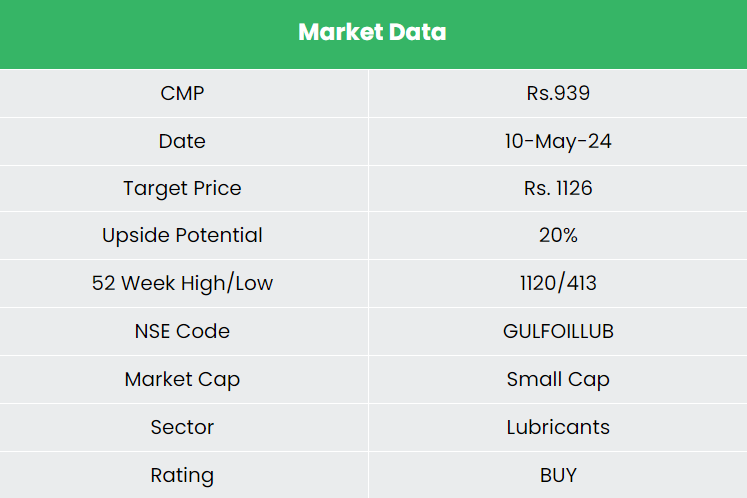

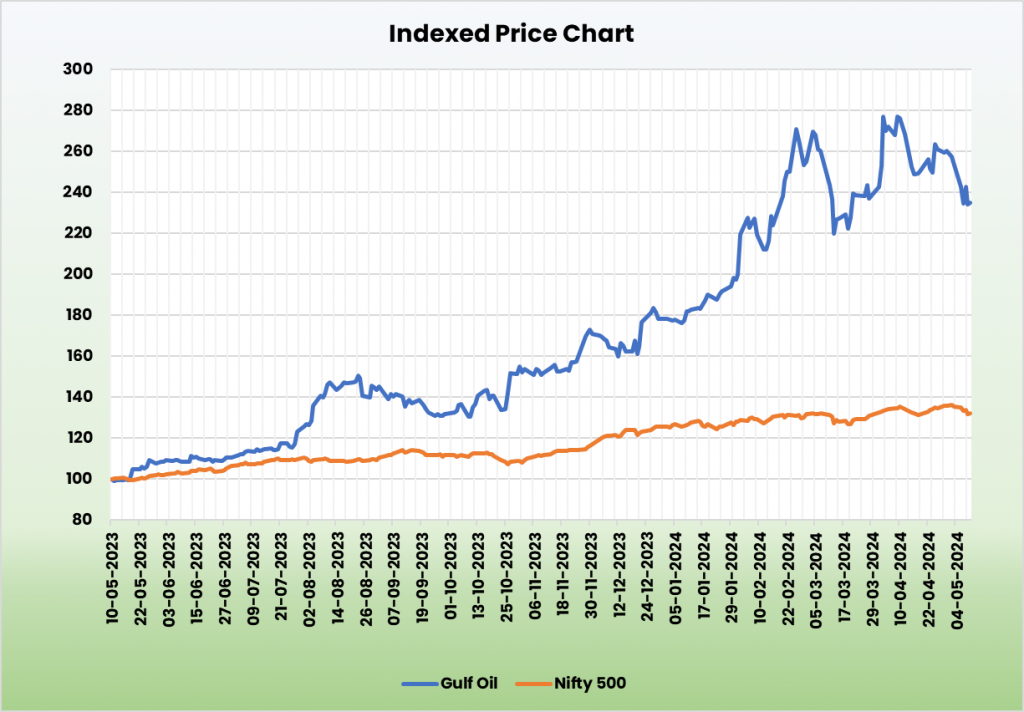

- Recommendation: We suggest a BUY rating for Gulf Oil stock.

- Target Price: Our target price (TP) for Gulf Oil is Rs.1,126, based on a 17x FY25E EPS valuation.

Risks

- Raw Material Price Fluctuations: Base oil prices, closely tied to crude oil, can directly impact profit margins.

- Geopolitical Crises: Supply chain disruptions due to geopolitical conflicts may hinder resource availability, affecting essential raw material supplies.

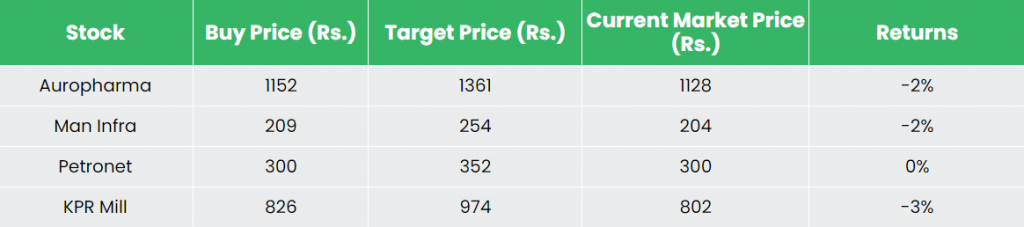

Recap of our previous recommendations (As on 03 May 2024)

Aurobindo Pharma Ltd

Man Infraconstruction Ltd

Petronet LNG Ltd

KPR Mill Ltd

Other articles you may like

Post Views:

16